Based on a bit of research ...I have found the following to be the reason of the current crisis .. more clear info on this page

1) A shakeout of the investment banking business model... Where people went long on long term mortgages with short term debt from more aggressive investors or banks

2) Lack of transparency on the value of the underlying assets ...More complexity in reporting

3) A fundamental premise that real estate assets have only one way forward...UP

Now wat lessons can we learn from this crisis situation (especially from an Indian economy point of view)

1) Health and value creation is key --- at the end of the day from a "Layman's" point of view ...you need to look for the balance sheet health before looking out for growth... companies with better balance sheet are more likely to weather this credit crunch period as compared to companies dependent on bank Overdrafts for fueling operations.

Verify ratios such as debt to equity and interest coverage ratios before looking out for income growth rate and revenue growth rate

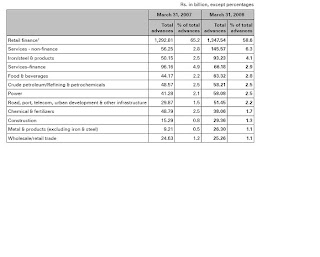

2) Retail and Mortgage loans are intrinsically more riskier as compared to corporate loans...Although the returns might not be commensurate with the risks for banks.To further stress this point let us consider the case of ICICI BANK (the god of all banks in India)...The banks asset composition is as follows

As shown in the figure RETAIL FINANCE accounts for a whopping Rs 1,292 Billion (or 65.2 percent) of its assets.The below figure shows the composition of the retail finance loans

Out of this Personal loans, Automobile loans, credit card and Home loans combined together contribute to 80 percent of the total loans.The underlying assets for these loans are not "self income generating" meaning unlike enterprises , capital loans or commercial loans the underlying assets in case of these loans are used for luxury purposes and are repaid by individuals whose "credit quality" are questionable or subjective and depends on several uncertain factors such as economy, employment and "repayment capability"

In its most recent quarter the Company reported about Rs 60 Billion in Non Performing Loans i.e approximately 10 percent of its total retail portfolio size . This ratio is pretty high when compared to its total NPA to total asset ratio of around 3.5 percent...The Company is also not that gung ho about retail loans anymore...infact they have

reduced on their retail loans as per the Company management

As we have said we

stopped doing business on the small ticket personal loans in

the month of November 2007 and that book is still running off.

So, once that book runs off say by the end of this calendar year,

one would see a lower impact in terms of provisioning on that

count. Overall we continue to be quite cautious on the retail

lending which I guess would be apparent from the retail loan

growth that we have seen in the current quarter and may be in

the last two or three quarters. We have tightened our credit

screens over the last six or nine months and we think in the

current environment with interest rates rising, inflation at a

higher level, we would not want to aggressively grow on the

retail side right now.

Clearly, retail loans are a pain area for banks.And banks with utmost exposure to the retail side of the business are likely to get fucked up in near to medium term.

3) Are we seeing a situation similar to sub-prime crisis here in India?

Ans: the real estate industry has clearly peaked during the last 3 years and is expected to dampen. Banks have become more cautious about their credit screens...and every Tom Dick and harry in a software Company with a total experience of 2 years wouldn't be getting housing loans for now....previously they used to get loans

But wat will happen to the loans already dipersed...only time can tell...depends on whether the employee taking the loan is leveraged (a typical leveraged employee earns approximate 70,000 per month but has EMI of 45 K for home, 10K for car ), the chances of him becoming unemployed ( once he becomes unemployed the risk of him coming under the NPA list is very high), income growth and as such the income generation capacity of individuals.

In a recessionary environment the chances of all this happening is pretty large . Consequently, although, a situation like the sub prime crisis appears to be far fetched, it does'nt look impossible.We would be able to analyse this situation in a better way once we have data on

1) the token size of each loan provided, te corresponing loan provided and the income generation capacity of each loan taker

2) the industry served by the loan taker (software, investment research and other service oriented industry might be risky currently)

I would get all the relevant data in a later post and analyse the gravity of the situation ....

As of now ...be careful...keep your cash, job... buy commodities and stock them and weather this downturn....